Apple

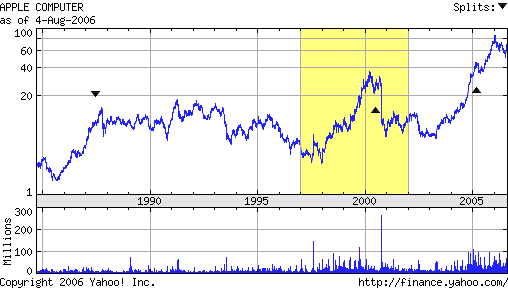

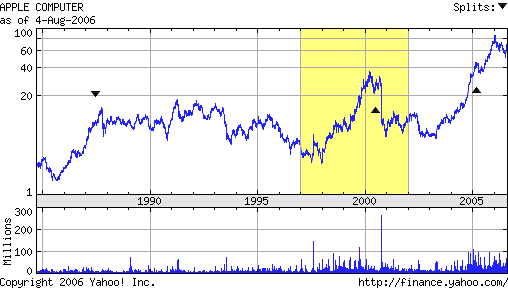

announced Thursday that it would have to restate past earnings since September 2002 and delay it’s FY2006 Q4 announcements. As a long-time investor in Apple Computer Inc., I was naturally concerned, especially with a drop in it’s stock price in such proximity to

expected product announcements on

Monday afternoon at

WWDC ’06 (covered live

here starting

2PM Pacific10AM PT).

What was wrong? Why was September 2002 significant? What are the possible implications? After digging around, I was able to get a clearer picture of the issue at large. I’m going to try to summarize what matters to investors and Apple enthusiasts, as well as to provide some background on the topic of options and the practice of backdating. If you don’t need the background, simply skip past the following section. What I won’t do is say what you should do with your stock (if you hold any).

What are options?

Options are contracts that allow the holder to purchase or sell an asset (in most cases, stocks) at a specified price until the contract expires. What’s relevant are

call (buy) options that are issued as part of a compensation package for a companies employees. There are many reasons why you pay employees with stock options as a complement or alternative to cash. First, you may not have much cash. Startup companies usually can’t afford to acquire and retain talented people with cash, instead offering them partial ownership in the company. This offers as incentive for them to do good work and promises a big reward in the event the company goes public (is put on the market). When this happens, an employee can exercise their options to buy the stock at a price discounted relative to the current market value and then cash them in for money.

So, while Apple has large cash reserves, it’s still a good idea to offer non-cash compensation in the form because they can use these reserves and more effectively reward good employee performance. For example, what’s another couple million dollars to Steve Jobs when you promise him the gains (or losses) he effects in the company’s share price. This is an effective way to award rich executives and keep them working hard.

There is a cost, however. Companies that are already publicly traded have a limit to the number of shares it can issue, and must get approval to increase this amount. This is necessary because although it doesn’t directly cost the company anything to issue new stock, increasing the number of shares dilutes the fractional ownership of each outstanding share. [Giving these shares to employees at a discount costs, on paper, that discount. -updated 10/12/06]

Forbidden fruit

While there’s nothing wrong concerning the practice in general, manipulating the date on which options are issued

constitutes fraud. According to Reuters (via the Scotsman), at least

80 companies are suspected of backdating by the SEC. In late June, Apple announced an internal investigation (via an independent party) over options issues occurring between 1997 and 2001, probably hoping to pre-empt action by the SEC. It was during this period of extraordinary growth (bolstered by sales of the original iMac) that tempted executives to risk fraud.

But why would anyone commit fraud when they could afford to compensate executives legitimately? Because they didn’t think they could get caught.

Cheating the system

Prior to August 29, 2002, companies didn’t have to immediately report options issued to employees to the SEC. This allowed them to essentially choose whatever date the company’s stock was low and put that down on paper, thereby locking in gains since that date. After

Enron and the passage of the

Sarbanes-Oxley Act of 2002, companies were held to higher standards of accounting requiring them to report the “transfer of economic value” (

Morningstar: Options Backdating: Will Your Stocks Pay the Price?) as an expense that factors into a company’s earnings.

If companies had to report options grants to the SEC, they would not be able to fraudulently manipulate dates. So if companies only started reporting the transactions in 2002, why does the period between 1997 and 2001 matter? How would anyone know if fraud was committed?

The evidence left behind

In an academic article written in 2005 (

Does backdating explain the stock price pattern around executive stock option grants?), Randall A. Heron and Erik Lie demonstrated that one could detect whether a company employed backdating by analyzing past stock performance around the dates options were supposedly granted. If a stock skyrockets exactly after the date options grants were recorded, that was probably a fraudulent date, especially because this behavior only consistently occurred before regulation began.

The article’s abstract:

Extant studies document that stock returns are abnormally negative before executive option grants and abnormally positive afterward. We find that this return pattern is much weaker since August 29, 2002, when the SEC requirement that option grants must be reported within two business days took effect. Furthermore, in those cases in which grants are reported within one day of the grant date, the pattern has completely vanished, but it continues to exist for grants reported with longer lags, and its magnitude tends to increase with the reporting delay. We interpret these findings as evidence that most of the abnormal return pattern around option grants is attributable to backdating of option grant dates.

Consequences

Summarized from

the Morningstar article by Pat Dorsey, the material impact of a confirmed scandal and its fallout would include unpaid taxes, lawsuits from shareholders (of which

there are two), accounting, legal and auditing costs, as well as the impact on the company due to stress on executives involved. The one that really concerns Dorsey is the concept of governance and “corporate stewardship”. Backdating seriously calls into question the character of the executives in breaching the most basic corporate responsibility to shareholders. Earnings restatements from companies mired in similar (although maybe darker) waters resulted in

$750 million over a two year period. [Restatements typically factor in the opportunity cost of giving employees options versus selling them on the market. -updated 10/12/06]

What about Steve?

In the Reuters article, analysts said the recent news didn’t change their valuation of Apple shares, but declared the

dismissal of Steve Jobs as the unlikely, but worst case scenario. [His position on the board of

directors also means he's liable.] We know that Steve Jobs was issued options to purchase up to 10 million shares but he could have been saved by the decline of Apple shares since 2001 and cancelled the options in 2003. Instead, he was awarded actual stock (at market value).

Conclusion

The internal origin of the inquiry and apparent non-involvement of CEO Steve Jobs are reasons for optimism, but in my memory, the integrity of Apple’s senior management has never been this deeply called into question. Backdating was by no means uncommon, but the extent to which Apple employed the practice has yet to be uncovered by the investigators. FYI, in case you think I’m shorting the stock, I’m holding onto it until further development and definitely through Apple’s Worldwide Developers Conference taking place August 7-11.